Montreal-based online meal solutions provider Marché Goodfood begins its new financial year reversing a 24-month negative trend. The number of active customers has just increased from quarter to quarter, for the first time in two years.

The board revealed on Tuesday that it had 124,000 active customers in the first quarter, up from 116,000 in the previous quarter.

To be considered an active customer, the customer must place an order within the last three months.

“Successive quarterly growth in the number of active clients can be explained by the typically more active back-to-school period,” Chief Financial Officer Roslane Aouameur said during a conference call with analysts on the sidelines of the latest financials presentation.

“The increase in customer activity was also a result of successful re-engagement campaigns that encouraged more customers to place orders,” she said.

Roslane Aouameur says Goodfood has made a big change in how it gets customers to order. “Previously, the push was to get people to try the concept. The concept is a little better known today. So it needs to be seen how it fits into the customer’s lifestyle, so the incentives are spread over more boxes, which reduced the amount of incentives per box, which increases the margin and profitability. »

She says it also helps attract customers who really want to see if this meal planning tool is useful for their lifestyle, rather than customers who want to get a free box and then have a little less reason to stick around after that.

Competition

Stifel/GMP analyst Martin Landry notes that loans and incentives reached 21% of net sales in the quarter, the highest level in four years, which may suggest competition for new customers is intensifying in the industry.

Despite the observed recovery, the number of active customers is still significantly lower than before. At one point at the height of the pandemic, Goodfood boasted more than 300,000 active customers.

The change in consumer behavior after the pandemic could explain the drop in the number of customers in the last two years.

The reorientation of activities and the exit from the on-demand grocery market could also affect the number of active customers, and thus the turnover.

Sales in the autumn months, namely October, November and December, fell by 14% to 40 million on an annual basis.

The decline in traffic must, however, be analyzed taking into account the fact that sales for the same period a year ago still included some revenue from the on-demand offering, an activity that Goodfood exited at the end of 2022 and which was supposed to embody the company’s future at its launch .

However, management managed to increase margins during the fall by cutting costs (salaries, leases, maintenance, etc.). Gross margin increased by 4% to 39% compared to the previous quarter. The net loss of two million kuna realized by activities during the fall was significantly reduced. A year earlier, it was 12 million.

Seasonality

Goodfood says it now offers a wider range of ready meals and says it is prioritizing ready meal solutions that include ready meals and groceries to complement.

Analyst Frédéric Tremblay of Desjardins Securities says he still has “limited visibility” on the incentives and marketing investments needed to reignite “significant and sustainable” sales growth in the coming quarters.

As Goodfood’s activities are seasonal, sales for the current quarter are likely to suffer from the holiday season that has just passed, during which the number of active customers tends to be more modest as a greater proportion of customers choose to suspend delivery of their baskets.

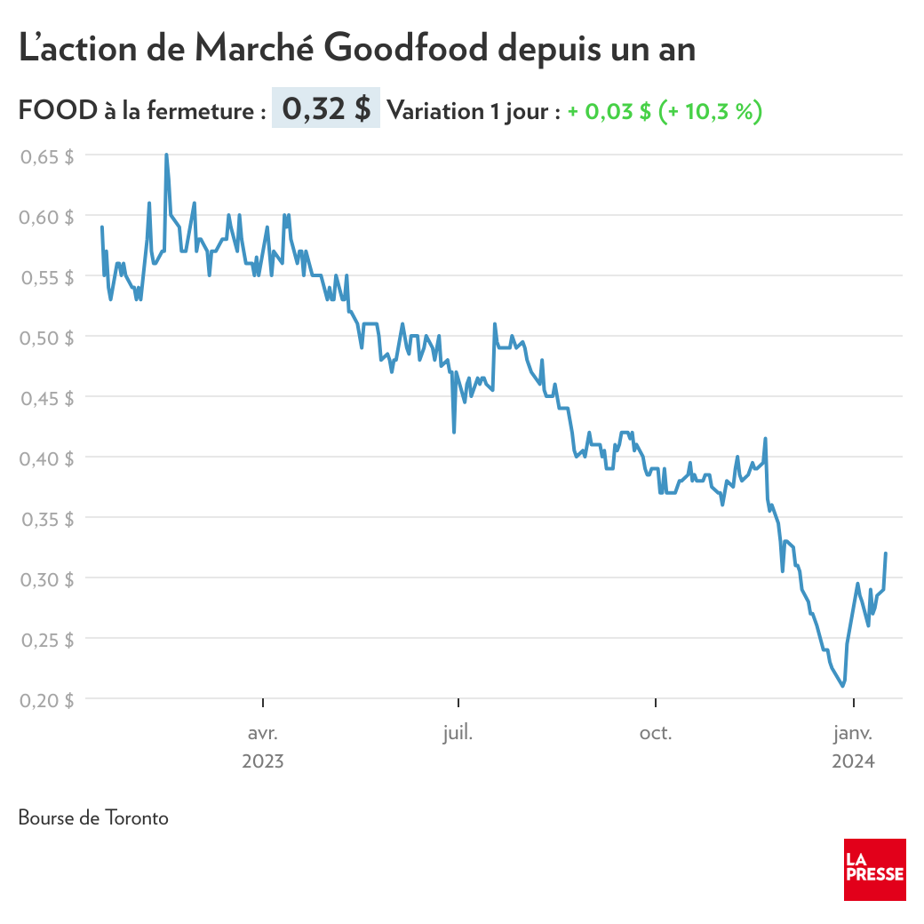

Goodfood shares closed Tuesday’s session up 10% at 32 cents on the Toronto Stock Exchange, valuing the company at $24 million.